Promote investment in the real economy

One of our proposals is to promote investment in the real economy instead of of investments in financial assets that have no productive counterpart.

One of our proposals is to promote investment in the real economy instead of of investments in financial assets that have no productive counterpart.

One of the obstacles for an economic recovery is that at this moment their is more investment in financial assets than in the real economy. Because of the low intrest rate, created by the Central Banks to help the governments to finance their debts, investors are looking for attractive investments.

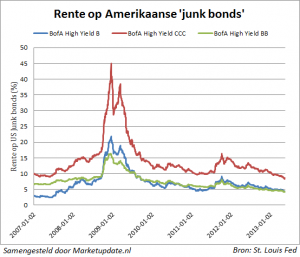

In the first chart you see the evolution of the intrest rates of american junk bonds. These junk bonds are bonds with a negative evaluation (Bn BB and CCC). In 2009 these bonds get a tremendous high rate. Nobody wanted these junk bonds anymore and the rate you get if you bought these junk bonds was very high. Today we see that these junk bonds have the same rate level as before the crisis. The save bonds don’t give any return anymore, so the investors are looking for other investments that give them a higher return.

The junk bonds are therefore an opportunity. So, this all depends on ultra-low interest rates, which allow junk-rated companies to refinance their debts indefinitely while pushing investors into riskier types of bonds. If the interest rates go a litle higher, the junk-rated compagnies can’t pay anymore their debts and the investors are loosing a lot of money.

The second chart makes this more clearly.  We see in this chart the relation between the evolution of the stock market and the evolution of the debt to finance the stocks. With the cheap money investors are gambling on the stock market and financing their gambling with debts. In 2000 and 2007 the debts peaks as well as the stock market. Each time we got a financial and economic crisis. Today it is worse. The debts to finance the stocks are lot higher than in 2007. A new crisis is ahead?

We see in this chart the relation between the evolution of the stock market and the evolution of the debt to finance the stocks. With the cheap money investors are gambling on the stock market and financing their gambling with debts. In 2000 and 2007 the debts peaks as well as the stock market. Each time we got a financial and economic crisis. Today it is worse. The debts to finance the stocks are lot higher than in 2007. A new crisis is ahead?

The problem is that their is no investment in the real economy. The cheap money is only used to play on the financial market. This can only result in a new financial and economic crisis.

Therefore Europe has to creates a path to lead the money to the real economy and to prohibit the financial gambling.

Leave a Reply